However if both 0 and 1 allowances will both give you a refund at the end of the year then by selecting 0 instead of 1 allowances youll end up with a bigger refund. Claiming 0 Allowances.

Claiming one allowance will most likely result in a refund when you file your taxes.

0 VERSUS 1 ALLOWANCE. Youre entitled to one allowance for yourself of a dependent but just because you are doesnt mean you absolutely have to. You can still claim zero. Claiming 1 allowance means that a little less tax will be withheld from your paycheck than if you claimed 0 allowances.

If your filing status is single and you have one job then this is the safe choice. An estimated tax penalty may apply if you owe more than 10 of your years taxes at the end of the year. With every paycheck or in one lump sum during tax season.

Heres when I would recommend you claim one allowance. Percentage Difference Between Claiming 0 1 2 or 3 Allowances for your W-4. Claiming 9 allowances on W4 form or even claiming 10 on W4 will certainly give you more money in your paycheck.

Should I 0 or 1 on a Form W4 for Tax Withholding Allowance being a dependent. Therefore Your take-home pay is going to smaller. I was just curious if there was a set difference in percentage between what you claim.

Claiming one allowance ideal if you are single with one job Youre single and have one job. How to fill out w4 to get more money in my paycheck. If you decide to claim zero you should know that.

The difference between claiming 0 and 1 on a tax return is that 0 means the taxpayer claims no exemptions while 1 means the taxpayer claims one exemption according to the IRS. The more allowances you claim on your W-4 the more you get in your take-home pay. In the past claiming one allowance meant that a little less tax was withheld from your paycheck over the year than if youd claimed zero allowances.

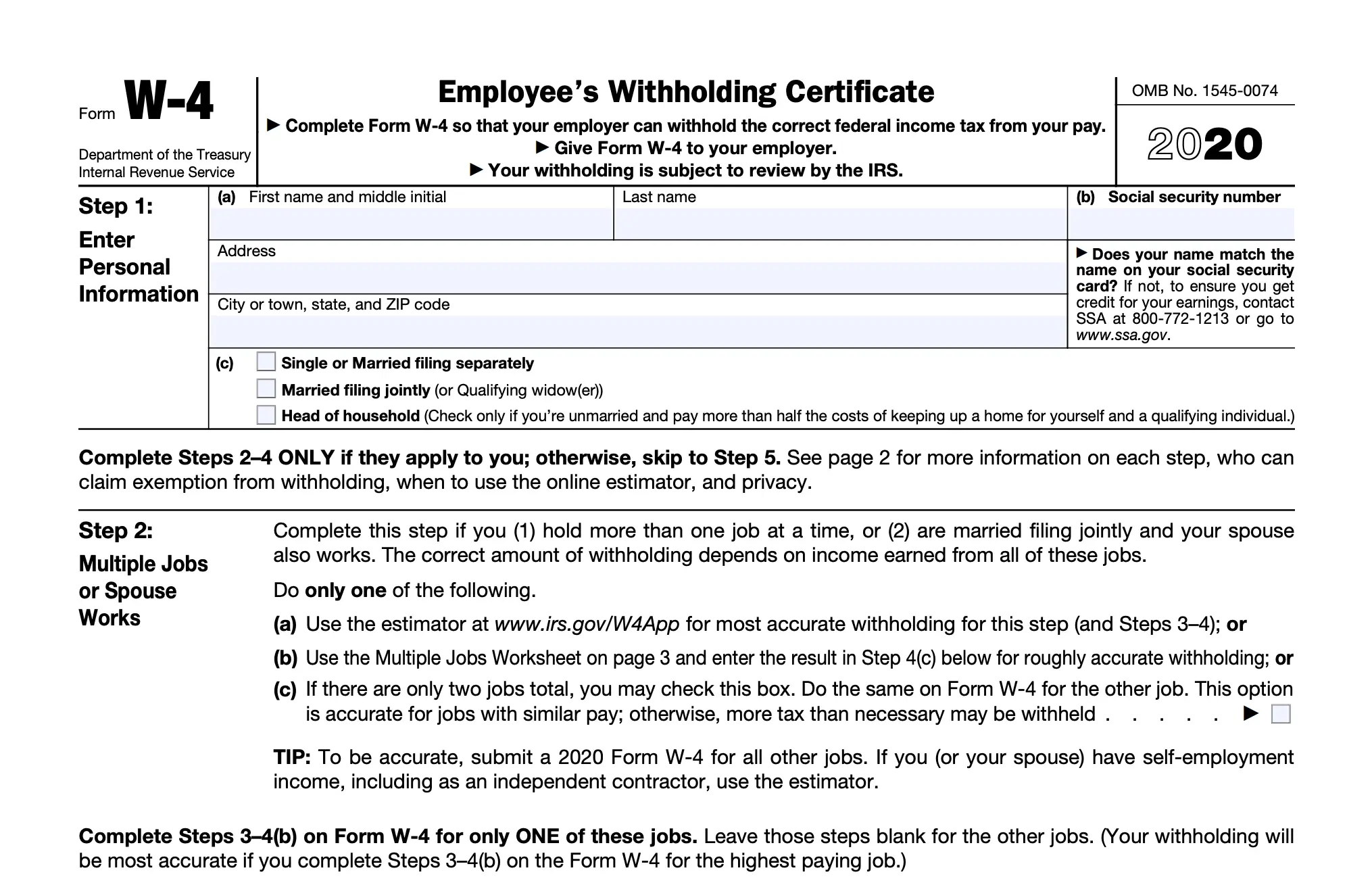

W-4 Basics When you take a new job your employer must give you a tax form called a W-4. The zero withholding allowance ensures that the individuals employer withholds the maximum possible amount relative to their tax bracket. If you put 0 then more will be withheld from your pay for taxes than if you put 1--so that is correct.

You can put a lower number if youd like to. If you claim zero it means the most amount of taxes will be withheld from your paycheck. Usually filling out your W-4 with the actual number of exemptions will get you pretty close to the correct withholding.

If youre not entitled to claim any allowances you should claim zero but if youre entitled to one allowance such as if you claim yourself as a dependent you can claim zero or one one if you want less withheld from your paycheck or zero if you want a larger refund at the end of the year. For example if you have 1 job you can either claim 0 or 1. When you claim 0 allowances your employer withholds the maximum amount of taxes from your paycheck.

It is given to employees to. Claiming 1 Allowance. The total amount of Rs1600 per month or Rs 19200 per annum can be claimed as tax exemption under this allowance.

In 2021 it doesnt matter if you claim 1 or 0 on your W-4. Your taxes will not be affected because you can no longer claim allowances. A taxpayer may take one exemption for each person for whom he is financially responsible.

Thats appropriate for a single person who is a dependent because they dont get to take their personal exemption. Should you claim 1 or 0 allowances. Each allowance you claim lowers the income subject to withholding.

It is most likely that by claiming 0 allowances on your W-4 you will get a big tax refund comes tax-filing season in April. The single withholding allowance identifies the taxpayer as non married and thus the head of the household. If you andor your spouse are working at more than one job you might claim 0 allowances to make sure enough tax is withheld on your earnings.

I know there are probably minor differences based on the person but I want to know if there is a rough basic percentage estimate for each level. The difference between claiming 1 and 0 on your taxes will determine when you will be getting the most money. Choosing 0 allowances treats 2250 0.

Ultimately a person ends up paying the same amount of money in taxes each year regardless of whether he or she claims a 0 or a 1 on a tax return. The IRS notes that each exemption reduces a taxpayers taxable income by 3650 as. Claiming two allowances will get you close to your tax liability but may result in tax due when filing your taxes.

Claiming a 0 on a tax form means that an individual pays more in taxes with each paycheck but might get a higher tax refund while claiming 1 takes less money out of a paycheck. Its as if youre saying that you will have a 6300 standard deduction but not take your personal exemption. Claiming 0 means you claim no tax allowances which will result in the maximum level of tax withholding.

When you get a paycheck from an employer some of your pay will be withheld to pay income tax. The amount of money withheld from your pay depends on the number of tax allowances you claim.

Custom Challenge Free Fire In 2021 Photo Poses For Boy Boy Poses Download Cute Wallpapers

Should I Claim 1 Or 0 On My W4 What S Best For Your Tax Allowances

Report Writing Template Download Unique Disease Theme Powerpoint Primary Sample How To Write A Theme Best Report Writing Template Job Resume Report Template

The Difference Between Claiming 1 And 0 On Your Taxes

Pin De Simon Norbert Em ایده طراحی صنعتی برای چفت و بست پلاستیکی Engenharia Mecanica Design De Produto Engenharia

Free Fire 1 Vs 1 Costume Thumbnail In 2021 Simple Background Images Logo Design Video Logo Design Art

Quick Pillow Corner Fix Sewing Templates Pillow Corner Sewing Cushions

How To Create 1 Vs 1 Custom Room In Free Fire Clash Squad Create 1 Vs 1 Custom Room In Free Fire Youtube

Fun Fit And Fabulous July 2010 Vitamins For Kids Vitamins Mineral Nutrition

Daily Student Budget Template Of Expense Xls Excel Budget Template Excel Budget Budget Template

Should You Claim 0 Or 1 On Your Tax Return

Should I Claim 1 Or 0 On My W4 What S Best For Your Tax Allowances

Section 7 Report Template Unique Psychology Resume Examples New Psychology Resume Templates Clinical Report Writing Template Job Resume Report Template

Should I Claim 1 Or 0 On My W4 What S Best For Your Tax Allowances

Magical Cosplay Discovery Metallics Solved Forever Cosplay Cosplay Diy Cosplay Tutorial

Youtube Transformers Artwork Transformers Optimus Prime Vs Megatron

Types Of Taxes Anchor Chart Financial Literacy Lessons Financial Literacy Anchor Chart Teaching Economics

Fun Fit And Fabulous July 2010 Vitamins For Kids Vitamins Mineral Nutrition